Undervalued Japanese Stocks

Overview

Scraping P/B ratios of 225 stocks in the Nikkei Index and graphing their composition ratios.

What is P/B Ratio?

P/B Ratio is Price to Book Value Ratio.

P/B Ratio = Market Price per Share/ Book Value per Share

The smaller the value, the more undervalued it is.

In Japan, it is called "PBR" instead of "P/B Ratio" and "PER" instead of "P/E Ratio".

List of Nikkei 225 Stocks

Scraping and listing with puppeteer.

Install puppeteer.

npm i puppeteerGet the list of stocks from this site.

日経平均プロフィル

I looked at the HTML of the website and found the target class.

class="row component-list" looks good.

<div class="row component-list">

<div class="col-xs-3 col-sm-1_5">4151</div>

<div class="col-xs-9 col-sm-2_5">

<a href="https://www.nikkei.com/nkd/company/?scode=4151">協和キリン</a>

</div>

<div class="hidden-xs col-sm-8">協和キリン(株)</div>

</div>

To be a little more specific, I decided that the separator should be "body > div.container > div.col-xs-12.col-sm-8 > div.row.component-list".

The following code created a list of ticker symbols and names.

type Item = { ticker: string; name: string };

async function crawl225(): Promise<Item[]> {

const browser = await pupeteer.launch({ headless: false });

const page = await browser.newPage();

const results: {

ticker: string;

name: string;

}[] = [];

try {

const url = "https://indexes.nikkei.co.jp/nkave/index/component";

await page.goto(url);

const selector =

"body > div.container > div.col-xs-12.col-sm-8 > div.row.component-list";

const rows = await page.$$(selector);

for (const row of rows) {

const divs = await row.$$("div");

const ticker = await (

await divs[0].getProperty("textContent")

).jsonValue();

const name = await (await divs[2].getProperty("textContent")).jsonValue();

if (ticker && name) {

results.push({ ticker, name });

}

}

} catch (err) {

console.error(err);

} finally {

await browser.close();

}

return results;

}

P/B ratios for each stock can be found on common stock sites such as yahoo finance.

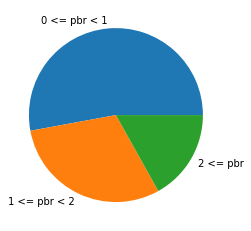

Plotting the result on a chart

Let's divide the stocks into the following three categories and give their composition.

- Less than P/B ratio 1

- P/B ratio 1 or more and less than 2

- P/B ratio 2 or more

I Use Python from here and display graphs with matplotlib. First, conver the acquired data to DataFrame.

import pandas as pd

df = pd.DataFrame(items, columns=["ticker", "name", "pbr"])

df["pbr"] = df["pbr"].astype("float")

You can extract rows with specific conditions by using query.

values = [

len(df.query("0 <= pbr < 1")),

len(df.query("1 <= pbr < 2")),

len(df.query("2 <= pbr")),

]

print(values) #[119, 68, 39]

Create a pie chart using matplotlib.

import matplotlib.pyplot as plt

labels = ["0 <= pbr < 1", "1 <= pbr < 2", "2 <= pbr"]

data = [119, 68 , 38]

plt.pie(data, labels=labels)

plt.show()

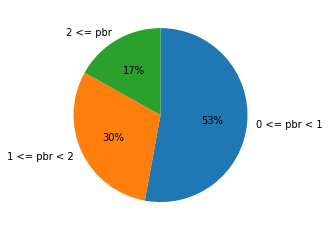

Add some parameters for clarity. startangle: start position. At 90, line up the items the 12 o'clock position on the clock. counterclock: Arrange the items clockwise. autopct: Display composition ratio.

plt.pie(data, labels=labels, startangle=90, counterclock=False, autopct='%.f%%')

plt.show()

Conclusion

About half of the stocks have a P/B ratio of less than 1.